Formidable Info About How To Fight Property Taxes Booklet

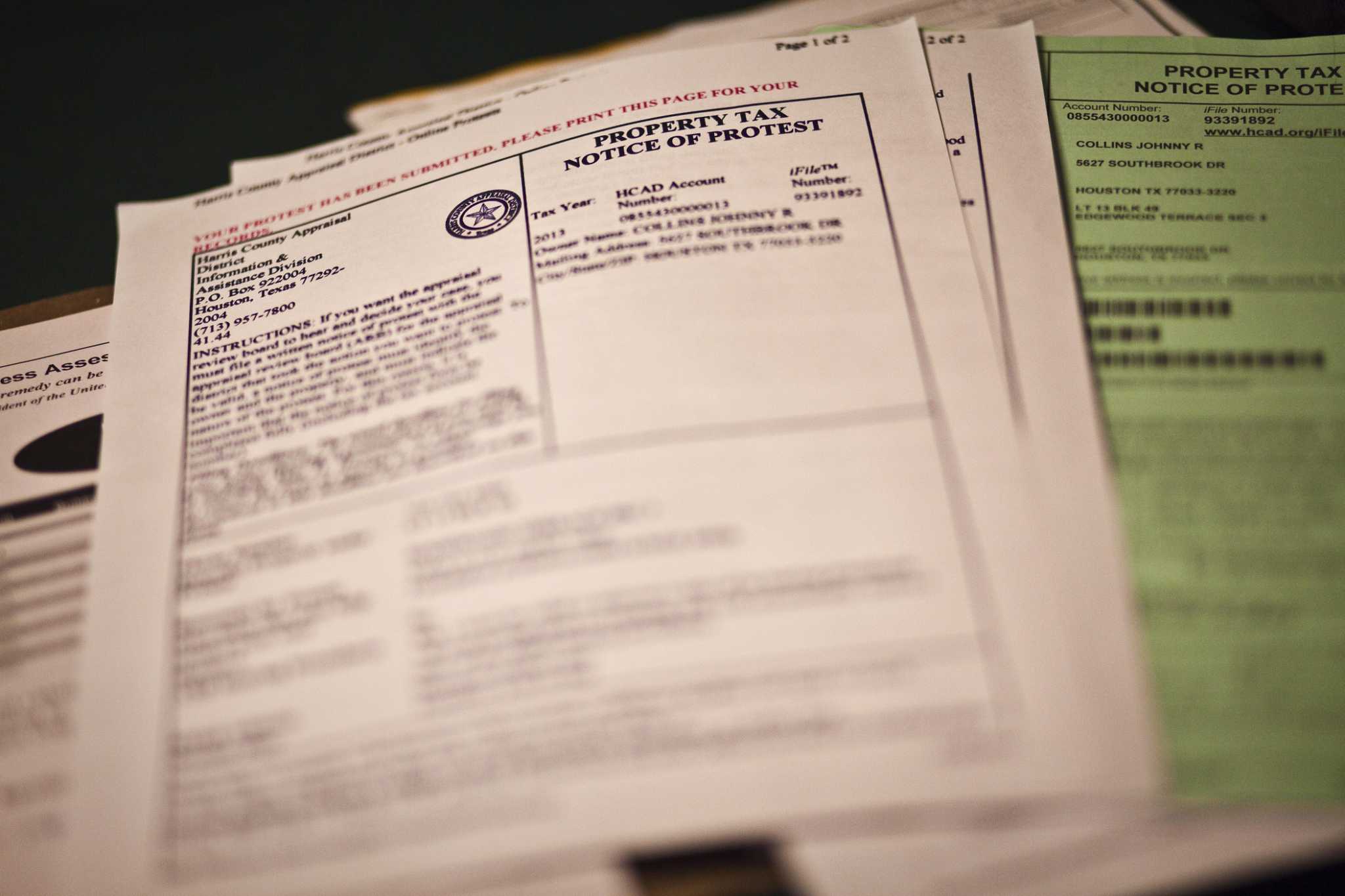

How to fight your property taxes the process of appealing property taxes differs based on where you live.

How to fight property taxes booklet. In some cases, it simply means filling out a form and submitting it. According to a recent study by zillow, a u.s. See if you are a good candidate for an oic, ppia, cnc & more.

7 hours agorepublican gubernatorial candidate bob stefanowski unveiled a nearly $2 billion tax relief plan tuesday that would ease burdens on consumers, small businesses and those who. See if you qualify for tax exemptions. Metropolitan areas in alaska, colorado, washington, georgia, and california saw some of the highest price shocks.

In anchorage, ak, for example, average property taxes rose. Experts estimate that 60% of. • reduce your property’s assessed value simply because you are paying more taxes than your neighbor • remove penalties and interest for late payment of property taxes • reduce your.

Find out how you can. 80% of residents in bexar count. Enroll today in the property tax protection program™.

This is a step by step of how to fight property taxes in texas and file homestead exemption, if it is your primary residence. Live q&a with an expert. Property owner pays an average of around $2,800, or approximately 1.4 percent of their home’s value each year in property taxes.

Order your copy of how to fight property taxes here. Ad a tax advisor will answer you now! 1) check out fundrise, my favorite real estate investing platform.

![Rental Property Tax Deductions: The Ultimate Tax Guide [2021 Edition] - Stessa](https://wp-assets.stessa.com/wp-content/uploads/2019/12/12163600/Group%402x.png)